Many of us face difficulties when trying to open password-protected PDFs downloaded from government websites such as the Income Tax Department or TDS sites. In this article, we will discuss how to decode the password for Form 16, a TDS certificate necessary for filing Income Tax returns.

Bạn đang xem: How to Decode the Password for Form 16?

What is Form 16?

- Form 16 is an acknowledgment receipt that confirms the deduction of tax from your salary, which has been deposited with the Income Tax Department.

- It is a certificate that certifies the details of your salary earned during the year and shows the amount of TDS deducted.

- Employers must issue Form 16 to employees on the 15th of every month.

- Form 16 is divided into two parts: Part A and Part B.

- Part A includes employer and employee details, PAN and TAN information, employment duration, and the number of TDS deducted and deposited.

- Part B specifies salary details, other incomes, deductions allowed, and tax payable.

How to Obtain Form 16 from the Employer?

- As an employee, you can request Form 16 from your employer.

- Form 16 cannot be downloaded directly by the employee.

- Even if you are no longer employed, you can ask your previous employer to provide you with Form 16 for filing your income tax return.

What is the Password for Form 16?

- Form 16 is always password-protected.

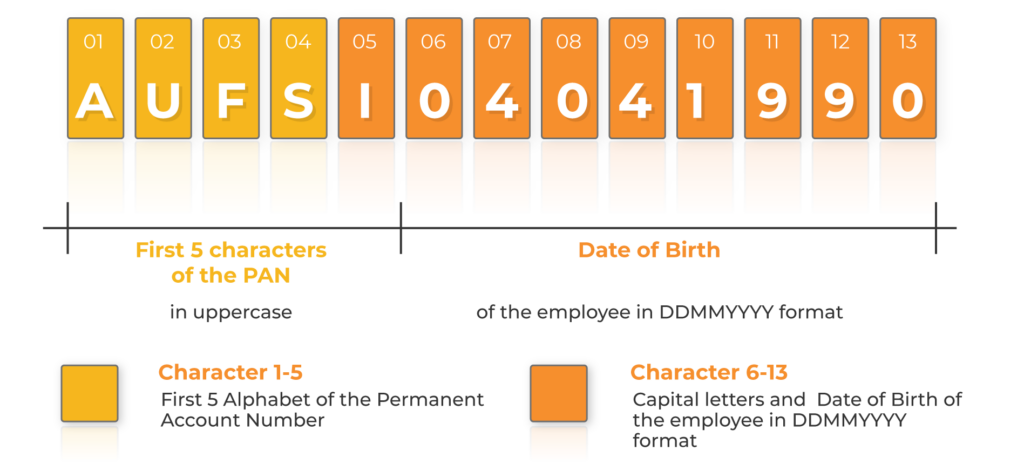

- The password for Form 16 consists of the first 5 characters of your PAN number in uppercase, followed by your date of birth in DDMMYYYY format.

- For example, if your PAN number is AUFSI0789Z and your date of birth is 4th April 1990, your password for Form 16 would be AUFSI04041990.

Xem thêm : A Beginner’s Guide to Clash Royale Game

Suggested Read: How to get errors corrected in Form 26AS?

Frequently Asked Questions

1. For which period is Form 16A issued?

Every quarter, Form 16A is generated, and the due date for Form 16A is the 15th of each month.

2. Is it necessary to file Form 16 with ITR?

Form 16 is a crucial document for salaried individuals filing their income tax returns. It contains information about salary earned, house property, other sources of income, deductions, and tax paid or deducted. It is essential to have Form 16 before filing your tax return. If you don’t have it, you will need to manually fill in all the information on the form.

3. What are the benefits of Form 16 and Form 16A?

Xem thêm : How to Factory Reset an HP Laptop

Form 16 and Form 16A provide data on TDS and income, which helps taxpayers when filing their income tax returns and calculating tax.

4. Is there a deadline for submitting Form 16?

Form 16 is issued to an employee once a year, on or before the 15th of June of the year immediately following the Financial Year in which income tax is deducted.

5. What is the password for Form 16B (TDS certificate for the purchase of property)?

- Form 16B, a TDS certificate for the purchase of property, is also password-protected.

- The password for Form 16B is the buyer’s date of birth in DDMMYYYY format.

- For example, if the buyer’s date of birth is 13th January 1997, the password for Form 16B would be 13011997.

Conclusion

Form 16 is essential for taxpayers as it facilitates smooth filing of returns, helps verify income details, and ensures correct TDS deductions. Understanding Form 16 and other relevant forms is crucial for filing taxes accurately.

Nguồn: https://eireview.org

Danh mục: Technology